HOW IT WORKS

Do you need to convert bank statements to Excel? With artificial intelligence capabilities, eFraud Converter will do the job faster, with more accuracy and less cost.

VIEW DEMO:

Let’s face it, analyzing hundreds of bank statements and thousands of transactions is tedious, nerve-racking and time consuming. What if you can turn this chore into a process that takes minutes instead of days?

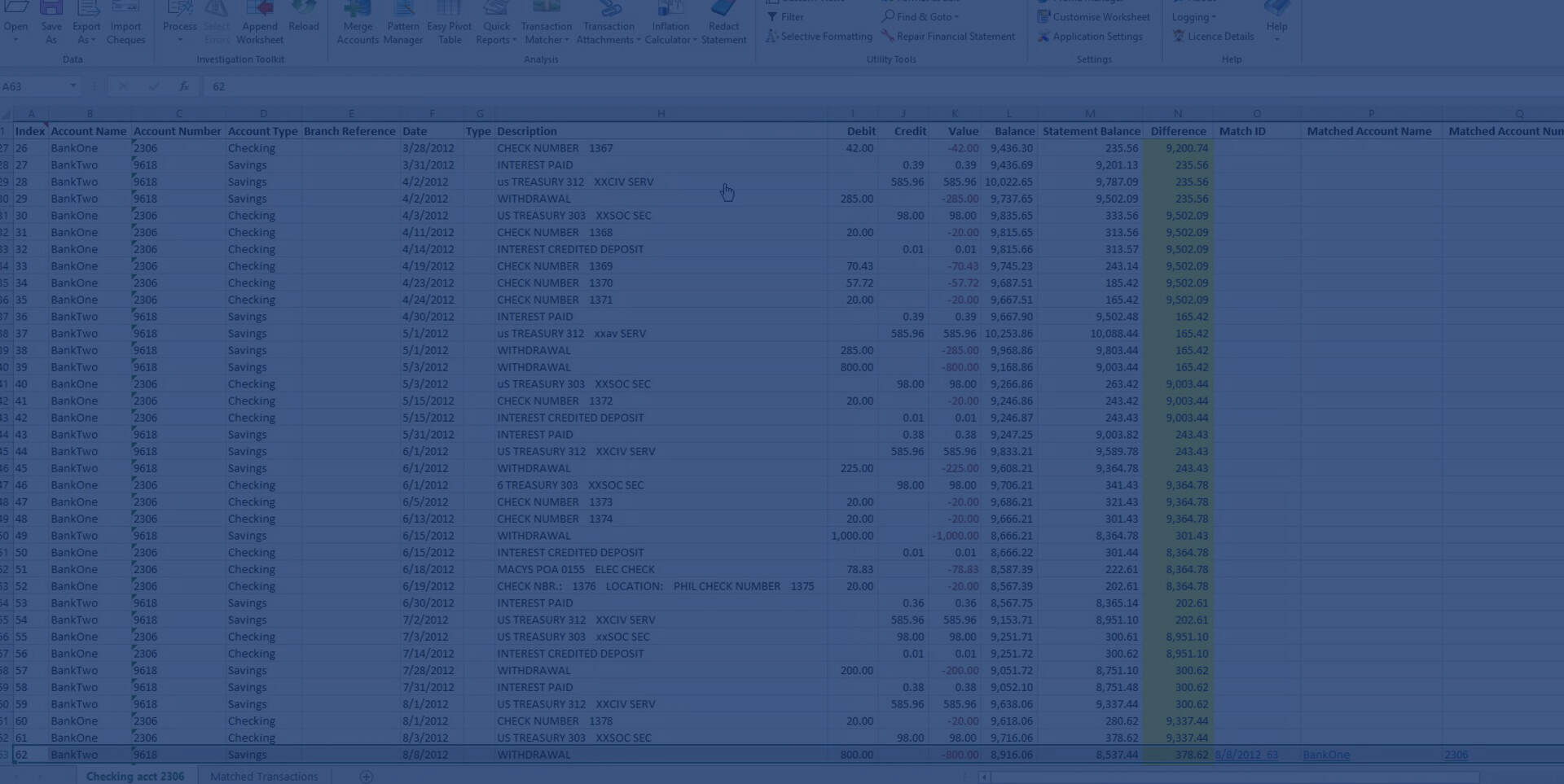

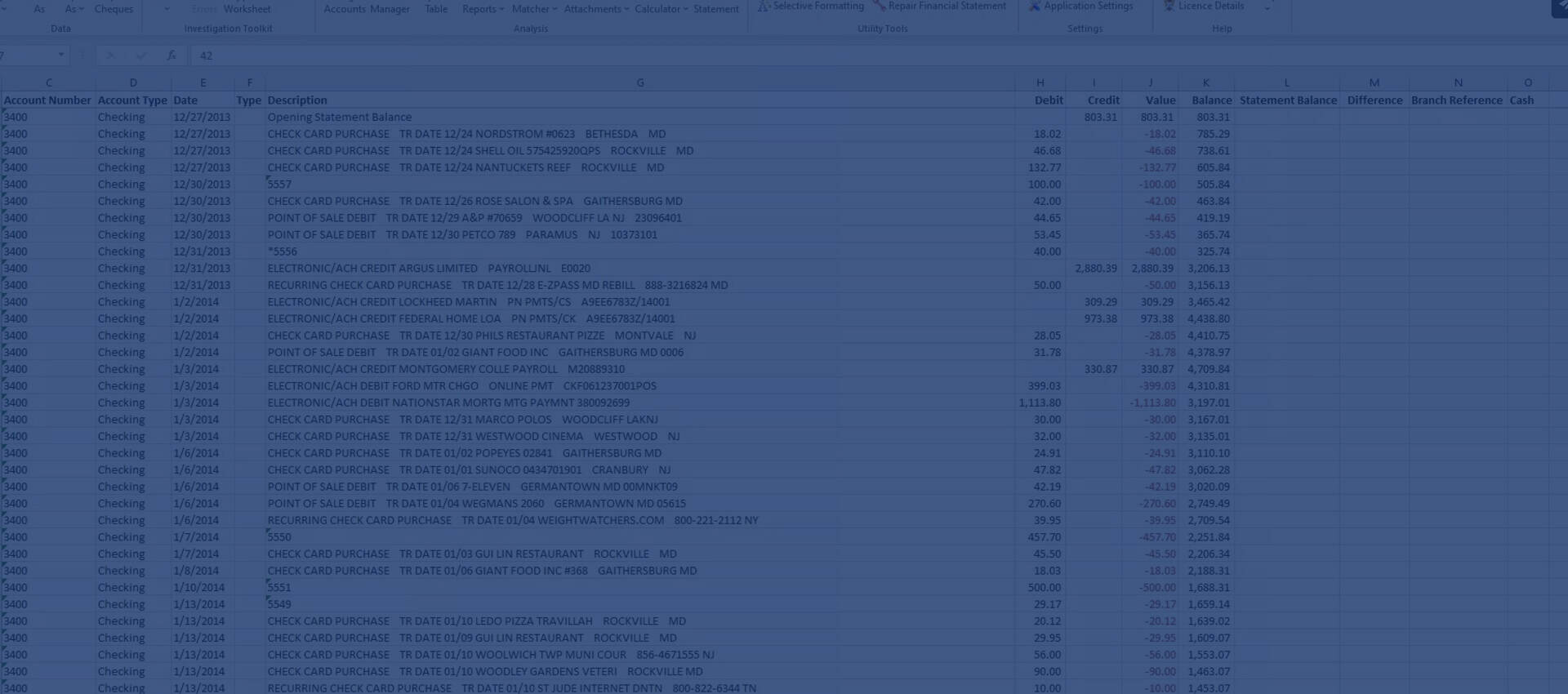

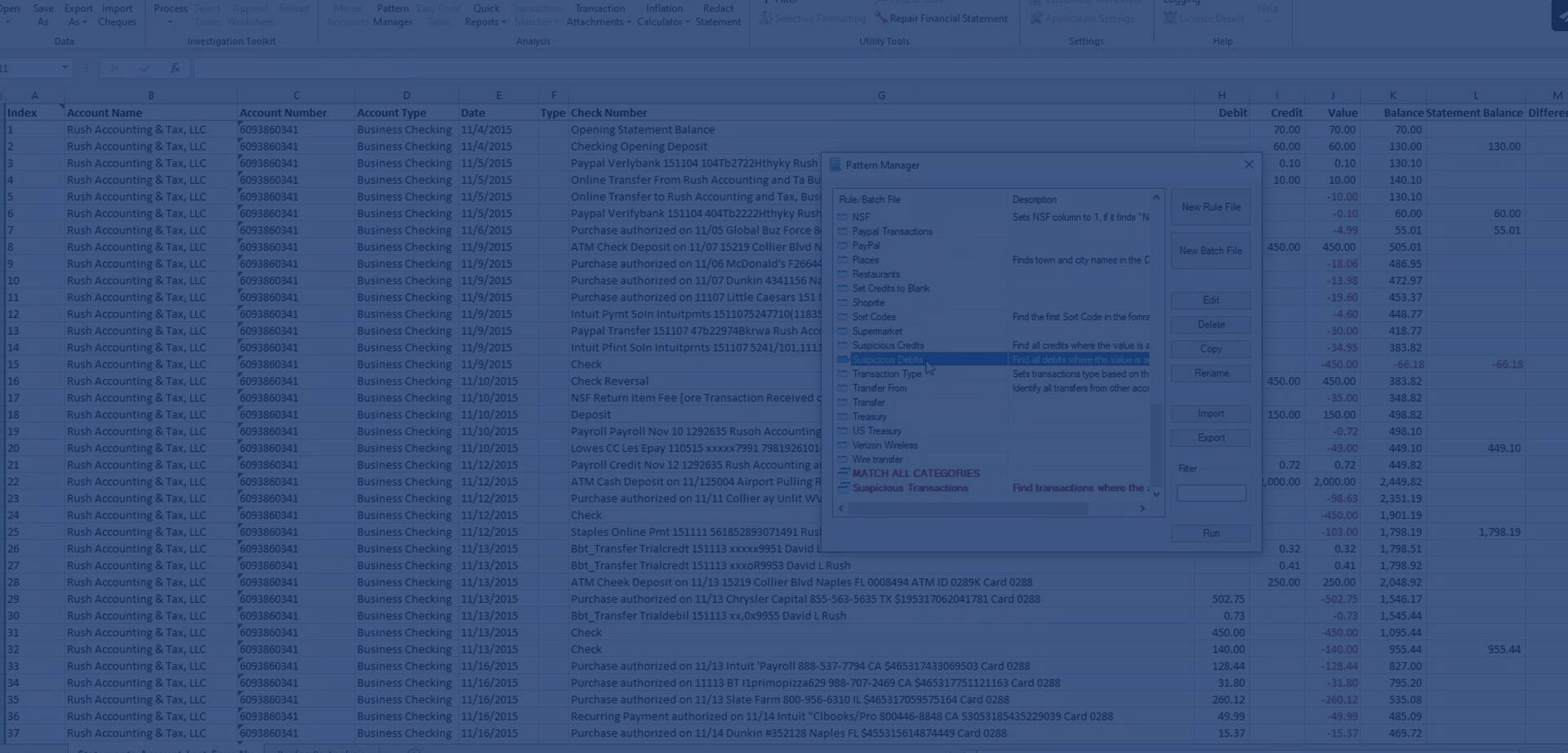

With the artificial intelligence capabilities of the Fraud Analyzer, you can do just that! This software is an Excel® add-in that includes a set of tools to quickly and easily analyze financial transactions.

CASE STUDY

NEW YORK – New York Attorney General Letitia James today announced a 20-count criminal indictment charging Aaron D. Fischman — former CEO of the now defunct company Cardis Enterprises International (USA), Inc. (Cardis) — with operating a multi-million dollar securities fraud scheme that defrauded over $22 million from investors across the country and around the world.

Pursuant to a money judgement against Mr. Fischman, the banking records of his attorney Lawrence Katz were successfully procured by subpoena.

Now, as a result of the subpoena process, it has been learned through a forensic analysis that over $31 million intended as direct investment into Cardis was diverted. It is believed that Mr. Fischman raised over $60,000,000, including money from offshore investors.

eFraud Services performed the analysis of 39 bank accounts that were used to perpetrate this fraud. The attorneys said “eFraud was able to accomplish in 2.5 months what we could not do in 2 years.”

BUSINESS CASE

| CASE | Aaron Fischman Investment Fraud | Burlington County Embezzlement | Ariel Quiros Money Laundering |

| Total time spent analyzing bank statements manually | 2000 hrs. | 300 hrs. | 2500 hrs. |

| With existing software | 200 hrs. | 12.5 hrs. | 233 hrs. |

| With eFraud | 10 hrs. | 1.7 hrs. | 11.7 hrs. |

| Labor reduction | 99.5% | 99.4% | 99.5% |

| Savings compared with manual | $398,000 | $198,867 | $497,660 |

| Total time spent analyzing bank statements manually | 2000 hrs. |

| With existing software | 200 hrs. |

| With eFraud | 10 hrs. |

| Labor reduction | 99.5% |

| Savings compared with manual | $398,000 |

| Total time spent analyzing bank statements manually | 300 hrs. |

| With existing software | 12.5 hrs. |

| With eFraud | 1.7 hrs. |

| Labor reduction | 99.4% |

| Savings compared with manual | $198,867 |

| Total time spent analyzing bank statements manually | 2500 hrs. |

| With existing software | 233 hrs. |

| With eFraud | 11.7 hrs. |

| Labor reduction | 99.5% |

| Savings compared with manual | $497,660 |

Have questions or need more information? We are available and ready to help. We can walk you through the process in more detail and guide you in determining which pricing option is right for you. All you have to do is send us an email, pick up the phone, or click the Chat button.

2430 Vanderbilt Beach Rd, Suite 108

Naples, FL 34109

Copyright 2022 eFraud Services All rights reserved. Terms and Conditions | Privacy Policy

Website Design and Development by Vectra Digital